Merck revenue falls

pharmafile | October 28, 2014 | News story | Manufacturing and Production, Sales and Marketing | Frazier, Merck, Q3, Victrelis, hep C, sovaldi

Merck has posted a set of disappointing financials for the latest quarter as it cuts cost across its business to help maintain profitability.

The second largest US drugmaker behind Pfizer saw sales slide by 4% during the third quarter to $10.6 billion as divested products, continuing patent expiries and a decline in hep C drugs income all took their toll.

Its hep C medicines have struggled against the juggernaut that is Gilead’s Sovaldi, a treatment that can effectively cure around 90% of patients and has seen astonishing sales of nearly $6 billion in the first two quarters.

Its new hep C offering, Victrelis (boceprevir) – which has only been on the market for two years – saw sales of just $27 million for the quarter, down 78% on this time last year.

The firm was also hit by $425 million of lower sales due to divestitures and the termination of a joint venture with AstraZeneca. In addition Merck saw falling Gardasil sales, dropping by 11% to $590 million, due to lower purchases by US government programmes.

But on the plus side, sales from Merck’s animal health business rose 11% to $885 million, which the company attributed to growth across all areas.

Spending cuts

Merck has struggled to gain a financial foothold for several years now, and its chairman and chief executive Kenneth Frazier has acknowledged this reality.

In a statement he says: “Last October [2013], we launched a multi-year initiative to transform Merck and build a platform for sustained, future growth. One year later, we[…]are making steady progress in our transformation, including divesting non-core assets, reducing our expense base and investing in our promising new product launches and pipeline.”

But part of this transformation have come deep spending cuts, aimed predominately at appeasing shareholders and increasing profit, with substantial cuts made in sales, general and administrative expenses as well as in research and development spending.

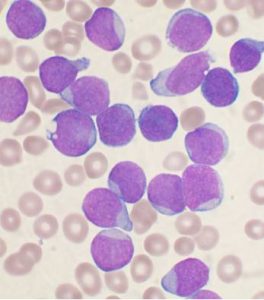

The shining light of the quarter was the FDA approval of its therapeutic skin cancer vaccine Keytruda, which became the first of a new type of drug known as a PD-1 inhibitor to reach the US market.

Sales are expected to reach around $2 billion at their annual peak (with it costing $12,500 per month in the US), but on the same day the drug was approved, its fierce rival in this space Bristol-Myers Squibb sued the company for breaching a patent for its PD-1 drug nivolumab.

But Merck has said it is not concerned with the lawsuit and even announced with its results that Keytruda had won a ‘breakthrough’ designation from the FDA, a situation that could bring its most promising oncology drug to lung cancer patients, and potentially within the next six months.

“Keytruda demand looks strong and obviously the breakthrough designation is a huge positive for Merck going forward,” says Tony Butler, an analyst at Guggenheim Securities LLC, speaking to Bloomberg. “They’re doing a great job on the oncology front,” he adds.

Ben Adams

Related Content

Merck to acquire Curon Biopharmaceutical’s B-Cell Depletion Therapy

Merck have announced that they have entered into an agreement with private biotechnology company Curon …

Merck and Daiichi Sankyo expand development and commericalisation agreement to include MK-6070

Daiichi Sankyo and Merck (known as MSD outside of the US and Canada) have announced …

CHMP gives positive opinion for Merck’s KEYTRUDA for unresectable or metastatic urothelial carcinoma

Merck (known as MSD outside of the US and Canada) has announced that its anti-PD-1 …