Merck sales fall in Q1 despite new product lifts

pharmafile | April 29, 2015 | News story | Sales and Marketing | Merck, Q1, Remicade

Merck’s sales were down in the first quarter of 2015 thanks to its consumer care divestment and increasing competition for key drugs – but new products are on the rise.

Total worldwide revenues dropped 8% from Q1 2014 to $9.4 billion, with a slight decrease of 2% in the pharmaceuticals division to $8.2 billion.

Chief executive Kevin Frazier remains optimistic, however: “Our strong performance this quarter demonstrates that our scientific and business strategies, together with our focussed investments, are paying off.”

Adding: “We remain focussed on bringing forward the best scientific and medical innovations. By capitalising on the exciting scientific and clinical opportunities that lie ahead, Merck is poised to play a major role in transforming healthcare for patients, as well as payers and shareholders.”

Remicade (infliximab), which is co-marketed with Johnson and Johnson, saw one of the biggest drops in sales as its revenues fell 17% to $501 billion due to biosimilar competition from Sun Pharma, Napp and Hospira.

The company’s hepatitis C (HCV) drugs Victrelis (boceprevir) and Pegintron (peginterferon alfa-2b) took a hit from the continued dominance of next-generation HCV treatments like Gilead’s blockbuster Sovaldi (sofosbuvir), with Pegintron’s sales falling by 50 per cent.

However Merck has a new contender for the market – combination treatment grazoprevir/elbasvir, which it plans to submit to the FDA in the first half of 2015.

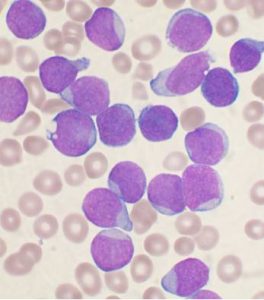

There was better news for the oncology division, which grew thanks to $83 million in revenues from the continued launch of melanoma immunotherapy Keytruda (pembrolizumab). The drug has seen a string of successes recently, including becoming the first treatment to be approved through the UK’s Early Access to Medicines Scheme (EAMS) and beating BMS’ Yervoy (ipilimumab) on survival in a clinical trial. The firm is also seeking FDA approval to use the drug in advanced non-small cell lung cancer.

In December 2014 Merck acquired antibiotics specialist Cubist, which added $208 million of product sales, including $182 million from antibiotic Cubicin (daptomycin). This helped offset the 9% negative impact from the divestment of the company’s consumer care business, which was bought by Bayer for $14 billion in May 2014.

George Underwood

Related Content

Merck to acquire Curon Biopharmaceutical’s B-Cell Depletion Therapy

Merck have announced that they have entered into an agreement with private biotechnology company Curon …

Merck and Daiichi Sankyo expand development and commericalisation agreement to include MK-6070

Daiichi Sankyo and Merck (known as MSD outside of the US and Canada) have announced …

CHMP gives positive opinion for Merck’s KEYTRUDA for unresectable or metastatic urothelial carcinoma

Merck (known as MSD outside of the US and Canada) has announced that its anti-PD-1 …