AstraZeneca to buy majority share in Acerta Pharma

pharmafile | December 17, 2015 | News story | Sales and Marketing | Acerta Pharma, AstraZeneca, acalabrutinib, acquisitions, mergers

Following several days of speculation, AstraZeneca has announced that it has agreed a deal to buy Acerta Pharma, a developer of cancer drugs, for up to $7 billion.

AstraZeneca had earlier confirmed it was ‘exploring potential strategic options with Averta’ and has now agreed a final deal. The package will see AstraZeneca acquire 55% ownership of Acerta for an initial $4 billion in cash – with $2.5 billion to be paid at closing and $1.5 billion due before December 2018. The agreement also gives AstraZeneca the option to acquire the remaining 45% ownership in Acerta for up to $3 billion.

It comes in the same week that AstraZeneca announced a deal to buy Takeda’s respiratory franchise for $575 million, and along with its biologics arm MedImmune launched a strategic investment in China to speed deliver biologics and targeted medicines.

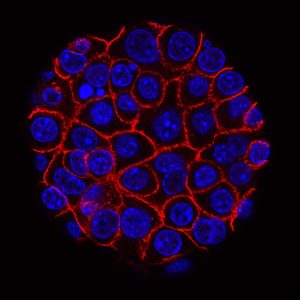

Acerta is developing several immunotherapy treatments for blood cancers, and has a pipeline of drugs that use the body’s own defences against the disease, and the move is seen as AstraZeneca’s attempt to buy a drug that can rival AbbVie and Johnson & Johnson’s Imbruvica (ibrutinib).

The candidate that is capable of going toe to toe with Imbruvica is the experimental drug acalabrutinib. It is currently in Phase III development for B-cell blood cancers and in Phase I/II clinical trials in multiple solid tumours, and is estimated to reach potential peak-year sales of more than $5 billion globally.

In a clinical trial Acerta presented at the recent American Society of Haematology meeting, 95% of patients with chronic lymphocytic leukaemia treated with acalabrutinib responded positively to the experimental drug, with a 100% overall response rate in a difficult-to-treat group of patients. The December 2018 payment may become due early if the first regulatory approval for acalabrutinib for any indication in the US occurs before this date, which may also trigger the butout clause.

Acerta executive chairman Wayne Rothbaum says the deal is attractive because “AstraZeneca has a strong track record of leadership in oncology and has shown a commitment to advancing the next generation of important therapeutics.”

And David Johnson, chief executive of Acerta, adds: “This transaction is a testament to the value inherent in Acerta and acalabrutinib. AstraZeneca brings tremendous expertise and resources that will help us maximise the potential of acalabrutinib as we continue down multiple development paths in both haematologic malignancies and solid tumours. We believe we will further accelerate our global clinical development program and maximise the future commercial potential of acalabrutinib.”

AstraZeneca chief executive Pascal Soriot says: “The investment is consistent with our focus on long-term growth and reflects the role targeted business development plays in our business model. We are boosting a key area in our comprehensive oncology portfolio with a late-stage, potential best-in-class medicine that could transform treatment for patients across a range of blood cancers. Acalabrutinib provides us with a small molecule presence in blood cancers to complement our existing immunotherapy approach, in collaboration with Celgene in haematological malignancies.”

Lilian Anekwe

Related Content

AstraZeneca shares results for Imfinzi in phase 3 trial for small cell lung cancer

AstraZeneca has announced positive high-level results from the phase 3 ADRIATIC trial, which demonstrated that …

FDA accepts BLA for AstraZeneca and Daiichi Sankyo’s datopotamab deruxtecan for breast cancer treatment

AstraZeneca and Daiichi Sankyo have announced that their Biologics License Application (BLA) for datopotamab deruxtecan …

FDA approves AstraZeneca’s Ultomiris for NMOSD treatment

AstraZeneca has announced that the US Food and Drug Administration (FDA) has approved Ultomiris (ravulizumab-cwvs) …