AstraZeneca in $5bn Acerta buyout talks

pharmafile | December 14, 2015 | News story | Sales and Marketing | Acerta Pharma, AstraZeneca, acalabrutinib, acquisitions, blood cancer, buyout, chronic lymphocytic leukaemia, mergers, takeover

AstraZeneca has confirmed it is in negotiations to buy cancer drug developer Acerta Pharma BV for more than $5 billion (£3 billion).

AstraZeneca has confirmed it is in negotiations to buy cancer drug developer Acerta Pharma BV for more than $5 billion (£3 billion).

The UK pharma company has confirmed reports in the Wall Street Journal that it is in discussions with Acerta, a privately-held cancer drug developer. In a brief statement, AstraZeneca says: “Further to recent speculation, AstraZeneca confirms that it is exploring potential strategic options with Acerta Pharma BV,” adding: “There can be no certainty that any transaction will ultimately be entered into, or as to the terms of any transaction.”

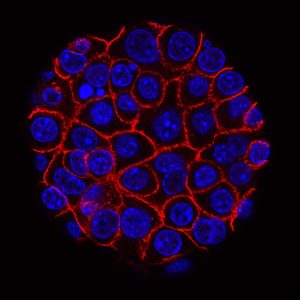

Dutch firm Acerta is developing immunotherapy treatments for blood cancers, and has a pipeline of drugs that use the body’s own defences against the disease. The most promising is the experimental drug acalabrutinib. In a recent clinical trial Acerta says that 95% of patients with chronic lymphocytic leukaemia treated with acalabrutinib positively responded to the experimental drug.

Industry intelligence suggests the Acerta drug could rival Johnson & Johnson and AbbVie’s Imbruvica (ibrutinib), which earned global sales of $304 million, with $267 million in sales in the US, in the third quarter of 2015. Imbruvica also posted positive clinical trial data at this year’s American Society for Haematology meeting in patients with chronic lymphocytic leukaemia and lymphoma.

AstraZeneca already has a portfolio of cancer products, including Tagrisso (osimertinib), which was approved by the FDA after an accelerated approval in November, and accepted into the UK’s Early Access to Medicines Scheme in December. In November AZ also announced a $2.7 billion deal for ZS Pharma, to acquire its potential treatments for the blood disorder hyperkalaemia.

Horizon deal for rare disease drug firm

Meanwhile, in another pharma M&S deal, Irish specialty drugmaker Horizon Pharma announced today it has agreed to acquire US firm Crealta Holdings for $510 million.

Crealta owns Krystexxa (pegloticase), the first and only FDA-approved medicine to treat chronic refractory gout, a rare type of arthritis.

Horizon said it expects the deal to add $70-$80 million to its net sales in the first 12 months after the deal closes.

Horizon chief executive Timothy P. Walbert says in a statement: “The Crealta acquisition further diversifies our portfolio of medicines and aligns with our focus of acquiring value-enhancing, clinically differentiated, long-life medicines that treat orphan diseases.”

Lilian Anekwe

Related Content

AstraZeneca shares results for Imfinzi in phase 3 trial for small cell lung cancer

AstraZeneca has announced positive high-level results from the phase 3 ADRIATIC trial, which demonstrated that …

FDA accepts BLA for AstraZeneca and Daiichi Sankyo’s datopotamab deruxtecan for breast cancer treatment

AstraZeneca and Daiichi Sankyo have announced that their Biologics License Application (BLA) for datopotamab deruxtecan …

FDA approves AstraZeneca’s Ultomiris for NMOSD treatment

AstraZeneca has announced that the US Food and Drug Administration (FDA) has approved Ultomiris (ravulizumab-cwvs) …