Merck KGaA’s sales climb but key drugs fall

pharmafile | May 19, 2015 | News story | Sales and Marketing | Erbitux, Merck, Merck KGaA, Q1, Rebif

Merck KGaA encountered an uneven start to 2015, with robust sales in the first quarter offset by declines in key products and increased spending on R&D.

Net sales in the healthcare division were up 7.4% from Q1 2014 to €1.6 billion, and revenues across the whole group were up 15.7% to €3 billion – although this was below analysts’ estimates.

“We are pleased that all three business sectors grew despite a challenging environment,” says Karl-Ludwig Kley, Merck’s chief executive. “We continue to expect slight organic sales growth for the full year as well.”

The German company’s biggest drug, injectable multiple sclerosis treatment Rebif (interferon beta-1a), saw sales decrease 16% to €430 million due to increasing competition from more convenient oral MS medicines, such as Novartis’ Gilenya (fingolimod) and Sanofi’s Aubagio (teriflumonide).

The firm relies heavily on revenues from Rebif, and has no clear replacement for it since the failure of its own oral MS pill Movectro (cladribine).

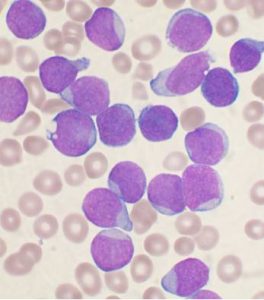

In addition, Merck’s other best seller, cancer medicine Erbitux (cetuximab), saw an ‘organic decline’ in revenues of 6% to €205 million.

However, most of the firm’s other key products including fertility treatment Gonal-f (follitropin alfa), cardiovascular medicine Concor (bisoprolol) and diabetes drug Glucophage (metformin) – grew in sales, with Glucophage registering the biggest climb at 26.5% to 112 million. The company says that this ‘more than offset’ the decline from Rebif.

It also strengthened its oncology alliance with Pfizer in the first quarter, agreeing to co-promote the US company’s lung cancer drug Xalkori (crizotinib) and beginning late-stage trials of their co-developed immunotherapy avelumab. The avelumab agreement could generate $2 billion for Merck if the product reaches certain milestones.

The deal is part of its new drive into immuno-oncology, and the Q1 results took a slight hit from increased research and development spending in this area.

“In 2015, we plan to invest heavily in immuno-oncology and together with Pfizer we want to build a strong position in this emerging research area,” says Kely. “Up to five further trials that could be pivotal for product registrations are to start this year, also in gastric and bladder cancer.”

But Merck will be playing catch-up to the multitude of other firms already working in the area, as the heavy presence immuno-oncology drugs at this year’s ASCO conference demonstrates.

George Underwood

Related Content

Merck to acquire Curon Biopharmaceutical’s B-Cell Depletion Therapy

Merck have announced that they have entered into an agreement with private biotechnology company Curon …

Merck and Daiichi Sankyo expand development and commericalisation agreement to include MK-6070

Daiichi Sankyo and Merck (known as MSD outside of the US and Canada) have announced …

CHMP gives positive opinion for Merck’s KEYTRUDA for unresectable or metastatic urothelial carcinoma

Merck (known as MSD outside of the US and Canada) has announced that its anti-PD-1 …